Curb impulse spending with one little question

Times are tight, y'all. Here's the tried-and-true trick that keeps me from overconsuming and overspending.

This issue is brought to you by Kreatures of Habit MEAL ONE, my go-to high-protein quick and easy meal. These delicious overnight oats are packed with 30 grams of protein and 9-10 grams of fiber; and provide a complete, balanced meal in just 3 minutes. Eat them for breakfast, bring them to the gym, pack one in your carry-on, and whip up a batch for your next hike. MEAL ONE offers the tastiest on-the-go oats around, and you can save 15% on your first order with the code MELISSAURBAN. (Make your first order a subscription and you’ll get an additional 20% off!)

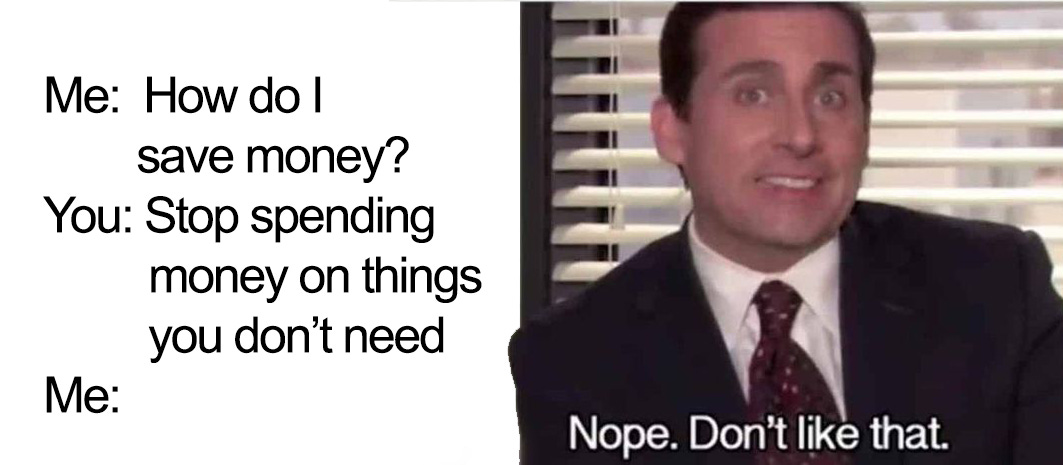

Last weekend, I was catching up with my sister. She mentioned browsing in a new store downtown when a gorgeous, super soft-looking sweater caught her eye. “It was heaven in a shirt. I would have snuggled it every day,” she told me. “So did you buy it?” I asked her. “Um, NO,” she said. “It was way too expensive. Yes, it was cashmere, but it was $400! I did not $400 like that sweater. I maybe $80 liked that sweater.”

This is a phrase that we’ve been using for as long as I can remember to help us make good decisions around purchases. It’s especially helpful for impulse buys, but it can also help you with “needs” like a new dishwasher or garage door. (Seriously, I used this trick when our garage door broke over the summer.)

It’s kind of like asking yourself, “Is it worth it?” when evaluating a food feedom choice, but it puts the decision in concrete terms, using a language we can all understand—money.

Do I $100 like it?

Here’s how it works: Imagine I’m out shopping at my local mall. (Note, it’s not as easy to do this online, but it can still work; I’ll explain.) I’m at the store and see a sweater I like. I’ll pick it up, look it over, then state my perceived value: “I $50 like this sweater.”

Then I look at the price tag.

If it’s $30, BOOM, that’s a steal! That doesn’t mean I buy it, but it does mean it meets my expectations of value. It also reaffirms that I’m not going to throw money at just anything. I then try it on, figure out where or how I’d wear it, and evaluate whether I already have something similar in my closet. (Spoiler: I do.) Then and only then do I make a decision about purchasing.

Now if the price tag comes up $100, it’s an automatic pass—do not hesitate, and do not doubt your own expert assessment. I’ve already set my expectations. I know how much value I’ve assigned to this sweater. I’m the expert on me! Seeing that someone else values it a great deal more doesn’t change how I feel about it. This sweater is not worth $100. It’s worth $50 (to me). Therefore this is not a good deal, and I’m walking out sweater-less.

But Melissa, what if it’s close… like $55 or $60? Then I have some thinking to do. Is it enough of a good value to consider purchasing? Am I willing to cough up an extra $5 or $10? Do I like it that much? At this point, I’d try it on, run through all of the other evaluations, and see where I landed. And if I did buy it, I will always remember that in my head, I overpaid a bit… so I’d better get my money’s worth and wear that thing a lot.

This works for bigger purchases too

The “do I $50 like it” concept works with a lot of purchases, not just clothes or shoes. When I was working on our new house, my designer submitted a number of throw pillows for my assessment. I found a set of pillows I really liked, and casually stuck a price tag to them in my head. “These pillows are maybe $40 apiece?” Imagine my shock when they turned out to be over $200 each! I immediately searched Homegoods and World Market for close-enough versions, and scored them for under $40 apiece.

You can also make this work for big purchases too. Our garage door broke over the summer; the spring snapped and the door was stuck in the closed position. The installer came over and went through our options. Finish, color, windows or no windows, some insulation or extra insulation, multiple cameras or one camera… We talked options and pricing, and at each discussion point, I asked myself, “Do I $600 need multiple cameras? Do I $1,000 need two windows?” (No and no.) We spent $5,000 because owning a home is stupid, but I only paid for the features I knew I’d appreciate, and I could not be happier with a significantly warmer garage and quiet, smooth rollers.

God, I’m old.

My best tips for this budgeting hack

Have you heard about the negotiation strategy of “anchoring?” It’s actually a cognitive bias where the first number shared (the "anchor") sets a reference point that heavily influences the rest of the negotiation. We assign a lot of weight to the first number presented—which is exactly how a price tag works. In the negotiation of, “Do I want to spend this amount on this product,” the price tag anchors your perception of how much you should be willing to spend.

My “do I $50 like it” strategy works because the price tag isn’t telling you how much it’s worth to you—you are. It’s a great way to keep yourself from overspending or buying things on impulse because everyone is wearing it. (I’m looking at you, $400 Kujten bandana scarf.)

However, there are a few things to keep in mind when you apply this hack:

Online shopping

It’s harder to practice this shopping online, because the price tag is right there, and you can’t physically handle the item to check for quality or fit. So in the case of online shopping, I’ll run through the process in reverse. I’ll buy something that I think will be worth the price, then play the “do I $50 like it” game when I get it home. It requires purposefully tossing out the significance of that anchor, which is hard, but gets easier with practice. If I spend $50, then try it on and feel like I only $25 like it, I return it.

I will also phone-a-friend (someone I trust to give it to me straight) with online purchases. I’ll order jeans online, then try the item on. If I’m on the fence about whether I $100 like them, I’ll send my sister a photo. “How much do you like these jeans?” Sometimes, she’ll say, “I’d pay $150 for them,” which tells me they could be a home run. Sometimes she’ll ask questions about the fit, comfort, and whether or not I really need another pair of jeans, then make her proclamation. Also, if if she says,

”they’re only $50 jeans” and I fight her on it, that tells me I really do $100 like them!

Unrealistic expectations with unfamiliar purchases

I experienced this with my pillows and curtains when I was designing our house. I figured, “How much could drapes for a sliding glass door cost?” Turns out, a lot, and there was no way I was going to find the kind of drapes I wanted for the price I had in mind.

For items you don’t buy regularly, this practice may not be the best way to vet your purchases, as the disparity could be huge. However, you can still price-compare, or try to find something close to ideal for less money, like I did for my pillows. With my drapes, I split the difference, buying a far less expensive pair at West Elm. I spent more than I originally imagined, but far less than my designer suggested, and I was happy with the final look.

Accountability and self-awareness

I’m a rule follower (and a Gretchen Rubin Upholder). If I tell myself, “I only $50 like them,” I don’t often struggle with trying to justify a $75 price tag. If you have a habit of negotiating with yourself in the name of instant gratification, however, you’re going to have to hold yourself to this practice. If you tell yourself, “I $40 like this sweater,” and find out it’s $100, you cannot spend the next three minutes trying to talk yourself into finding $60 more value in the thing. Remind yourself that you determine the value, not the price tag.

This is an excellent opportunity practice sitting in whatever emotion is coming up for you when your brain pitches a tantrum in Aritzia: “But I waaaaant it.” Why do you want to spend more money than you know this thing is worth? What emotion is underneath what suddenly feels like an immediate need? How can you hold your boundary around this purchase and practice in a way that feels like self-care and not punishment? (Am I even still talking about sweaters?)

Beyond budgeting…

This really isn’t about the sweater, although sticking to your budget and not over-consuming are huge wins. Holding yourself accountable is an important exercise that carries over into other areas of your life. Every time you employ this “do I $50 love it” practice, you remind yourself that you are the ultimate authority on you, and that you can trust yourself to make the choices that support you best.

XO, MU

Kreatures of Habit doesn’t just make the tastiest overnight oats… they also make the DAILY BAR, your new fitness, travel, on-the-go BFF. Packed with 20 grams of protein, 9-10 grams of fiber, and 3 grams of creatine, these tasty bars can help you hit your protein goal and get a functional dose of creatine (which can have benefits for those of us in menopause). If you’re already an oats fan, try the DAILY BAR and save 20% on your first order with the code MELISSADAILY.

You taught me this a few years ago when I bought my Dyson hairdryer. I did NOT $400 love it, so I returned it. I did $200 love the Shark.